When credit cards can be good

Many frugal-minded individuals would advise against credit card use. After all, the interest rates are horrible, and they make it all to easy to spend. However, there is one important fact about credit cards that the credit card companies don’t want you to know:

- If you pay off your credit card balance in full before the due date, you are under no obligation to pay interest or fees.

Why is this important? Because it means I can put something on a credit card today, but not actually have to pay for that purchase until weeks later. Think of it as a short-term interest-free loan. As long as I have the cash to pay off the balance in full, there’s no expense to me. It means I can leave my money in an interest-bearing savings account a little longer before I actually pay for the gas I use. However, this small amount of interest isn’t what I’m after. More valuable to me are the points.

|

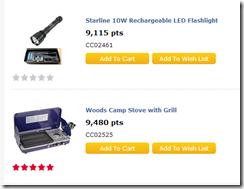

| Some nice things, under 10,000 points |

I use my credit card to pay for things I would normally pay cash for anyway; gas for my car, bill payments, and even groceries. By the end of the year, it’s not difficult for me to accumulate 12,000 points or more. I’ve estimated each 100 points to be worth roughly one retail dollar. At around the time of the holiday season, I browse the catalogue. There’s usually some nice things to be found. As a last resort, there area always gift cards and movie theater passes that make for great stocking-stuffers and casual “Friend” gifts that always make me look like a swell guy. When I say, “Honestly, it was really nothing,” I’m telling the truth.

Doing the combo

|

| A free night out at the movies for a few air miles |

With an air miles card, I can earn even more points on top of the ones I earn on my credit card. I don’t go out of my way just to collect air miles, but if the local Shell station just so happens to have the best price on gas (which does happen on occasion), I’ll swipe the air miles card first, and then the credit card. The points accumulate a lot slower, but they do accumulate over time so that, one day, surprise surprise, I can get something worthwhile totally for free! Air miles don’t need to actually be used for air miles; they can be used for merchandise and gift cards just like the points on my credit card. The beauty is that it still doesn’t cost me anything extra. I’m buying something I need to buy anyway, and the cost of buying is the same no matter how I pay or what cards I swipe.

Arguments against and responses

|

| Canadian Tire money is always worth collecting |

Conclusion

I don’t believe that a points card system tied to a single store is worthwhile, unless I frequent that store often, which is rarely the case. The free points credit card works for me because it is unobtrusive, non-demanding, and yields sufficient points at no expense to me to redeem for something nice and worthwhile. To me, this really contributes to better living through frugality. Used properly, credit cards are beneficial to me. Perhaps one day these points systems won’t be worthwhile; but until that happens, I’m going to always put myself in the position of greatest gain with the least amount of effort, which means collecting points when and where it works for me.

No comments:

Post a Comment