Monday, 31 December 2012

Happy new year!

It's the last day of 2012. What a year! It's been difficult for me, and many others around the world. As I reflect on 2012, I have to admit that, through all the hardships that this year dished out, it was frugality that helped in a big way. I don't pretend to be perfect; my path is guided with frugality, but I know I'm not frugally perfect, so I'm going to make some frugal resolutions for 2013 to help guide me closer to frugal nirvana.

The first resolution I'll make is to commit to weekly updates of this blog for the entire year. Every Friday, expect to see fresh, new content, with original photographs.

My second resolution is to commit to a 2:1 ratio when it comes to acquiring stuff. What this means is that, for each new thing that comes into my house, two things must go. This is part of my on-going efforts to de-clutter, as well as to provide me with a moment to consider if I really need that new thing. Whether it's selling through eBay, donating to Goodwill, or just gifting to someone, two things must go for every thing that comes in.

Finally, I'm going to resolve to spend more time enjoying life. 2012 was all about my new career, house, and adapting to the changes that occur as a result of a career and house change. I'm finally feeling settled in both, so I'm going to commit to at least a couple of weeks of "Down" time, to travel and enjoy life. This part is all about giving myself back some time.

All the best to you and yours in the upcoming new year, and if you have any resolutions you'd like to share, feel free to share them here.

Friday, 28 December 2012

Inkjet printers: A second look

|

| My first printer: Commodore MPS 802 |

The case for the all-in-one

|

| My trusty, crusty Canon S300 |

The modern cost of laser

|

| A reliable, reasonably cost-efficient, personal laser printer |

The Samsung CLX-3305FW colour multifunction seems a remarkable deal, currently on sale for around $180. A black toner cartridge for this printer costs $75, and yields 1,500 pages, for a cost of 5 cents per page! Each colour toner cartridge costs $75 each, and yields 1,000 pages, for a cost of 22.5 cents per page. This is heading into inkjet territory. The HP LaserJet Pro M1212nf, a monochrome laser all-in-one priced at around $130, has toner cartridges that cost around $95 each and yield 1200 pages each, for a cost of 7.9 cents per page. What's happening here? It appears as though the laser manufacturers have borrowed a page from the low-cost ink jet printer makers: Sell the laser printers at extremely low prices, and make huge profits from the consumables (toner).

The case for ink jets

The all-in-one inkjet I opted for was the HP 6500a plus. A high yield black ink cartridge costs around $40 and yields up to 1200 pages, for a cost of 3.3 cents per page, squeezing out my laser printer. Each of the three high yield colour ink cartridges costs $20 and yield up to 700 pages, for a cost of 8.6 cents per page.

|

| My new all-in-one HP OfficeJet |

Conclusion

Friday, 21 December 2012

Happy holidays!

|

| Christmas 1978 in the Quirk house |

Friday, 14 December 2012

Fixing the School Budget Crisis

Flashback to the 80's

|

| The future from the Commodore 128 manual |

It's 2012, not 1912

Welcome to 2012. The technology has matured. These days, it's expected for assignments and essays from students to be completed on a computer system. Many text books can fit on an SD card much smaller and much more durable than a 5 1/4" floppy disk. The power of an entire computer system dedicated for reading these textbooks has been reduced to the modern eReader; a device which can cost less than a high school text book. These devices can establish a wireless connection to a global network of information. Textbooks can be stored efficiently in digital format, and can be updated at any time with minimal effort.

|

| Weighing an average textbook |

Adding up the savings

|

| The Kobo Touch |

Assuming that each of the 711,345 students will require an e-reader that will be replaced after 5 years, the cost of the e-reader at $75 each plus shipping would represent a $10.74 million dollar annual expense. Assuming that half of the e-textbooks would never need to be replaced because the content would not change for that subject, a one-time investment of $28.5 million would pay for sufficient quantities of these, which could be reasonably budgeted over a 20 year cycle (to allow for updates to accommodate modern language use), representing an expense of $1.42 million per year. If the other two books per semester are updated in 5 year cycles, they would represent an expense of $5.7 million. This would put a projected budget for e-reader based textbooks at a total of $17.86 million per year. The savings represented in this scenario would be $25.34 million per year.

Conclusion

Clearly, having our school boards switch to e-books represents significant savings and advantages that cannot be ignored. We taxpayers need to demand that our school boards catch up to the modern age and provide our kids with the best education for our dollar, and a big part of that strategy is through the adoption of e-books and e-book readers.

Friday, 7 December 2012

Appreciating the value of space

The true value of space

More space usually costs more in terms of money or time. If I want a bigger house, I’ll pay more. I can trade off some of my time; the further away I live from a big city, the bigger house I can buy with a given amount of money. The result is a longer daily commute. If time was a premium in my life, I’d live right in the downtown core. If money was a premium, I’d live far up north. Given the more time made available by living downtown, I could invest more time into earning more money to buy a bigger house. At the other extreme, I might not need to invest as much time to earn money. I live somewhere between these two extremes; this allows me to pick and choose what I feel are the best aspects of both worlds for my own tastes and desires.

The perils of filling up space

|

| Are they really worth it? |

Filling up my space with things has the same effect as filling up my schedule with only productive things or budgeting every penny for productive expenditures. Eventually, my life at home would make me a slave to those things, with no free space to just play, unwind, and relax.

The creep

|

| Our first house, at 995 square feet |

Eventually, we did what many homeowners do, and bought a bigger house. That, too, eventually filled up, and so we repeated the cycle again. With each move came the realization that there was more stuff to move. When we started out, everything fit in a standard U-Haul truck. By the time we got to the house we’re in now, we were overlapping closing dates so we’d have a week to truck things from the old house to the new.

We didn’t just buy a new house for more space; it made economic sense as the value of our house went up, interest rates on mortgages went down, and our equity grew. Our mortgage payments remained the same as they were in that first townhouse, but the equity we realized with each sale kept growing. So was the amount of stuff we were accumulating.

Doing the purge

|

| A library of wasted space left unbought |

We are now starting to look at purging as something we do as a family ritual. By making it an annual event in our household, it becomes something to celebrate and look forward to. Like many others, we tend to do this in the spring.

The joy of more space

A new show on HGTV called “Consumed” really helped to illustrate the intangible benefit of exchanging stuff for more free space. This show became a favourite in our household, as it demonstrated to us that most people prefer more free space over more stuff to fill that space, and has helped to increase our consciousness to this effect. It’s also helped us to be conscious of what we buy and how we buy it. We now recognize the true value of digital content and streaming video services. The value of the bargain bin DVD or blu-ray diminishes greatly once it’s viewed as another piece of clutter to manage after we watch it one or two times, when compared to a service like Netflix where we might find the same movie available for streaming for less than three bargain bin DVD's. No more compact discs to add to my clutter with online music services. E-readers allow us to buy a huge library of books with which to read, some of them free, and there’s no box of books to get rid of.

I’ve concluded that it’s the content that enriches our lives, not the stuff; and seize every opportunity to extract the content and eliminate the stuff. It’s an ongoing process, and one I’m glad to have added to my frugal lifestyle.

Friday, 30 November 2012

Free stuff (that’s actually worthwhile)

I like to enrich my life with things that entertain and educate me. Life is more than just work, sleep, eat, and pay the bills. Music, literature, art; there’s so much to life that makes me glad to be alive every day.

The Internet has been a great liberator of music, literature, and art. When I was growing up in the 1980’s and in the early to mid 1990’s, free entertainment meant turning on a radio or television and hoping that something being transmitted on some channel was something I might enjoy. The things that were really good were usually cut down, censored, and littered with commercials, so there was a price to pay. I eventually tired of this fare, and found myself at a public library. There were limitations here as well; how long I could borrow a book before returning it, assuming they had the book I wanted to read.

Things are much better today. There is an abundance of quality free stuff with which to fill my leisure time. With no further ado, I will now present to you free stuff that’s actually worthwhile.

Free Internet

There are ways I can access the Internet without paying anything for it. Most common are free wi-fi hotspots, such as those offered by McDonald’s and Tim Hortons, though these places of business generally expect me to purchase something, so it’s not really free. Some public libraries do offer truly free wi-fi, as well as access to the Internet from their own computers. There are also neighbours who leave their wireless routers unsecured, but this option usually stops becoming viable when they discover they’ve gone over their bandwidth limit and secure their access point, inevitably changing the name of their wireless LAN to something like “Dontstealthis.”

There are other initiatives. Some in my city may have access to Oshawa Free WiFi, while companies like NetZero’s 200MB 4G plan or free 10 hours of dial-up surfing might work for some very light users. Personally, I find free access plans to be too limited for my own tastes, so I turned the entire equation upside down and use competition and technology to my advantage.

I start by assuming the cost of Bell home phone,at $52.95 a month. This comes with the features I expect of a modern home phone. If I assume this as a monthly expense as a homeowner, I can now justify going with a company like Teksavvy and order their high speed DSL for $29.99 and TekTalk premium phone with even more features than Bell’s phone for $14.95. In my area, I also need to pay a “Dry Loop” fee of $10.00 per month, so I end up paying $1.99 more than I would pay with Bell’s phone service. This also requires an investment of approximately $100 in hardware. I consider the hardware cost an investment, given that the alternative is a rental fee, and the extra $1.99 a month exceptional value. Just try to get high speed internet with a 300GB cap for $1.99 a month.

Free Computer

There’s no need to spend hundreds of dollars for a new computer. People practically give them away. Seriously. Just put the word out in a local community, or browse through a local freecycle’s listings. My experience has been mixed; one can expect to receive old CRT monitors and computers that are unable to play the latest games, but are perfectly fine for e-mail and web browsing. These tend to be ridden with viruses and malware, so I tend to bring these up to date quickly and easily by wiping the hard drive clean and installing a modern free operating system like Ubuntu.

Free (worthwhile) Operating System

I recommend using Ubuntu. It’s very mature, at version 12.10 now, and it’s an operating system I like to run. Have an old computer that’s not quite running right? I’ve seen plenty of frustrating Windows XP based computers that run so slow, it makes people want to give them away. Ubuntu makes these computers run like new. It’s remarkably easy to use; easier than Windows XP in my experience. It also opens the door to all kinds of free applications, which then opens the door to all kinds of free online content, which I will get into next.

Free (worthwhile) content

I like to read books. As I get older, I derive even greater pleasure from reading the great classics. Many great classics have become public domain, and as they do, the best works end up at Project Gutenberg. When I bought my first e-Reader, it came with 100 free books that originated from this site. Their library has grown to over 40,000 free e-books.

Sometimes, I would rather have a book read to me. I discovered talking books at my local library when I had my first job that involved a commute by car. Nothing makes the aggravation of sitting in traffic go away like listening to a great story. Now we have LibriVox, which is to audiobooks what Project Guttenberg is to written texts. Its library, while considerably smaller, is still worthwhile at 6,000 titles.

When it comes to music, I’m aware of all the methods to obtain music illegally for free. What is surprising is the amount and quality of legally free music, shared by its creators under a “Creative Commons” license. Creative Commons music spans all genres. A search that includes my genre of choice followed by the words “Creative Commons” results in plenty of material to discover.

In the early 90’s, I started to listen to talk radio. Imagine if there were more programs in that genre that appealed to my specific tastes. Now this dream has come true with podcasts. There must be a podcast out there for every taste imaginable. Much like audiobooks, a good podcast can make a long drive much more interesting.

Free (worthwhile) Software

In my previous blog, I had the habit of posting my top 10 free software picks of that year at the end of the year. LibreOffice is my office suite of choice. For managing Podcasts, I like gPodder. To manage my eBook library (including news feeds), I use Calibre. Generally, I find Souceforge.net to be an excellent resource for games and software of all types. In fact, there’s so much good quality worthwhile software available, I’m going to dedicate that to another blog post.

Conclusion

There’s a lot of good things out there for free if one knows where to look. I’ve just scratched the surface here. What I discovered is that it’s easy to become overwhelmed, so I tend to discriminate when making my choices. Perhaps you know someone who would benefit from the free information I provide in this blog. Feel free to share this with them, and make their lives a little better.

Friday, 23 November 2012

Making credit cards work for me

When credit cards can be good

Many frugal-minded individuals would advise against credit card use. After all, the interest rates are horrible, and they make it all to easy to spend. However, there is one important fact about credit cards that the credit card companies don’t want you to know:

- If you pay off your credit card balance in full before the due date, you are under no obligation to pay interest or fees.

Why is this important? Because it means I can put something on a credit card today, but not actually have to pay for that purchase until weeks later. Think of it as a short-term interest-free loan. As long as I have the cash to pay off the balance in full, there’s no expense to me. It means I can leave my money in an interest-bearing savings account a little longer before I actually pay for the gas I use. However, this small amount of interest isn’t what I’m after. More valuable to me are the points.

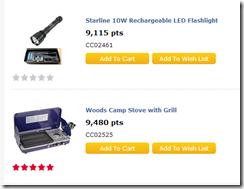

|

| Some nice things, under 10,000 points |

I use my credit card to pay for things I would normally pay cash for anyway; gas for my car, bill payments, and even groceries. By the end of the year, it’s not difficult for me to accumulate 12,000 points or more. I’ve estimated each 100 points to be worth roughly one retail dollar. At around the time of the holiday season, I browse the catalogue. There’s usually some nice things to be found. As a last resort, there area always gift cards and movie theater passes that make for great stocking-stuffers and casual “Friend” gifts that always make me look like a swell guy. When I say, “Honestly, it was really nothing,” I’m telling the truth.

Doing the combo

|

| A free night out at the movies for a few air miles |

With an air miles card, I can earn even more points on top of the ones I earn on my credit card. I don’t go out of my way just to collect air miles, but if the local Shell station just so happens to have the best price on gas (which does happen on occasion), I’ll swipe the air miles card first, and then the credit card. The points accumulate a lot slower, but they do accumulate over time so that, one day, surprise surprise, I can get something worthwhile totally for free! Air miles don’t need to actually be used for air miles; they can be used for merchandise and gift cards just like the points on my credit card. The beauty is that it still doesn’t cost me anything extra. I’m buying something I need to buy anyway, and the cost of buying is the same no matter how I pay or what cards I swipe.

Arguments against and responses

|

| Canadian Tire money is always worth collecting |

Conclusion

I don’t believe that a points card system tied to a single store is worthwhile, unless I frequent that store often, which is rarely the case. The free points credit card works for me because it is unobtrusive, non-demanding, and yields sufficient points at no expense to me to redeem for something nice and worthwhile. To me, this really contributes to better living through frugality. Used properly, credit cards are beneficial to me. Perhaps one day these points systems won’t be worthwhile; but until that happens, I’m going to always put myself in the position of greatest gain with the least amount of effort, which means collecting points when and where it works for me.

Friday, 16 November 2012

The Dollar Store

The Great Illusion

|

| My friendly neighbourhood dollar store |

|

| Four for $2 < $1.00 each |

These juice tumblers are packaged together and are sold for $2 at Wal-Mart. At the dollar store, one might find glass tumblers exactly these being sold individually for a dollar. The profit margin for these glasses is doubled for the dollar store, answering my questions I once had. Indeed, shopping at the dollar store might not be the frugal thing to do, unless you need only one juice tumbler. Here is a case where a frugal student looking to stock their cupboards with kitchenware would find their dollars stretched further by not shopping at the dollar store.

What I do buy at the dollar store

|

| Dollar store batteries |

|

| Patch Cord, $1.25 |

When my son has a project to do for school that involves some sort of arts and crafts, I might give him a few dollars and send him to the dollar store to buy the things he needs. When it comes to materials for arts and crafts, the dollar store is hard to beat. They may lack the variety of a place like Michael’s, but the prices are significantly cheaper and I’ve noticed no difference in quality.

Conclusion

What do you think?

Friday, 9 November 2012

Learning to manage my time

Choosing the right one for me

|

| A pocket sized day planner |

Day planners come in all shapes and sizes; from the basic, simple pocket-sized compact monthly calendars to the deluxe leather-bounded models that are so large, they have their own carrying handle. Neither extreme would do for me. After carefully considering my needs, I decided to choose something small enough to fit in my pocket so as not to add to the already burdensome load of textbooks and binders I was required to carry every day. It had to be able to contain enough detail that I could store my contacts, to-do lists, and weekday schedules broken down by the hour. I also wanted it to have tear-off page corners so that I could quickly flip to the current day.

I would have thought my ideal day planner would have been much more common than it actually is. I discovered that many were either too complex or too simple, and the tear-off page corners weren’t as popular as I thought they should be. Nevertheless, I found what I was looking for, and immediately set to employing it in my daily life.

Time can make money, but money can’t buy time

|

| My spouse favors the larger day planner |

The day planner to me was to my time what the spreadsheet was to my money, with one important difference. While I was well on my way to increasing my monetary income significantly, there was nothing within my power to create any more time. My daily budget of time was, and remains, exactly the same as everyone else’s. Further, I could spend it any way I wanted, with my daily allotment replenished tomorrow.

I started off by filling in my class schedule, followed with the hours I was scheduled to work as a lab technician. I then added times I needed to catch the bus. I left a block open for lunch, and then tried to fill the gaps with peer tutoring sessions. With my day planner on me at all times, I could quickly confirm and book appointments, as well as keep on top of the commitments that were required of me. I was no longer at the mercy of my own imperfect memory.

I soon discovered that, in spite of me doing more in my life, I had more free time. My days, organized into blocks of time, were full of purpose. No longer was I looking for ways to while away the gap hours. Projects were completed well before deadlines, and late night cramming for exams was unnecessary. I always knew what had to be done, and as I filled every hour of my days with purposeful tasks, my evenings and weekends were truly mine to do as I pleased. In my third year, I had enough time to add a third part time job as a software developer and analyst with a local company, which turned into my job placement; as well, I had taken up new weekly routines like swimming once a week and travelling on my weekends. I was truly transforming into the person I wanted to be, and I had my frugal time and money management ways to thank.

Into the future, PDA’s and beyond

|

| My first ever PDA |

|

| My Motorola flipout, an Android phone |

Today, I favour Google Calendar. It’s free and syncs with my inexpensive Android smartphone. Further, it adds the new dimension of collaboration with other Google Calendar users. When I make an appointment with someone and enter their e-mail address, they can confirm the appointment and it shows up on both of our calendars. It’s so easy and effective, and the benefit of taking back control of one’s life makes the effort well worth the investment of time.

Sunday, 4 November 2012

Foretelling the future

Discovering the tool to predict

My aging Amiga 500, a computer that got me though the first year in 1993, was no longer up to the task in 1994. With courses like math, communications, word processing, and accounting in my first semester, I managed reasonably well, but my micro computer application course in the second semester required me to spend a greater deal of time in the computer lab at the College than on my own computer. Most of the computers we used were older PC XT’s from the 1980’s, most of which had no more than 640k of RAM; though the College did have a lab of new ‘386’s. I had acquired through my program business applications that ran on a basic 640k PC, but did not run on my Amiga very well, as the Amiga was intended more for games. One of the programs I had learned to use in the middle of my second semester was the Lotus 1-2-3 spreadsheet. Having dealt with cash flow difficulties, I understood the true power and utility of this software which I will share.

I should clarify that spreadsheet software existed for the Amiga as it did for all microcomputers of the day, but purchasing business applications for the Amiga represented another expense. As well, nothing on the Amiga compared to the standard-setting Lotus 1-2-3, dBase, and WordPerfect on the PC that I had at the time. Finally, it was pretty clear that the Amiga had become a dead platform with Commodore declaring bankruptcy in 1994. I had learned to use Lotus 1-2-3, I had Lotus 1-2-3, and I had a host of other industry standard and recognized business applications and programming languages I used in my course that did not run on Amiga, except very poorly with emulation. I calculated the cost of building a working PC from used parts would be more cost and time effective than would be acquiring and learning the equivalent business software for the Amiga, and that a career in the industry would be more promising by sticking to the standards. Amiga was a leftover from my pre-frugal days, and represented a loss I had to cut.

In the fall of 1994, I set out on a mission: With a budget of only $100, I was going to build a usable PC from used components that I could use at home to run the software used for my course. This would save me on bus fare, as I wouldn’t need to make those extra trips to do homework in the computer lab; it also gave me an edge in that it allowed me to practice any time I wanted. I went over budget by $10, but I had built, out of an Epson Equity case and motherboard, a ‘286 PC with 640k of RAM, a 30MB hard drive, a 1.44MB floppy, and a fairly large and pleasingly crisp amber monochrome display. I loaded up my spreadsheet, and started punching in the data.

|

| A mock-up of my first financial forecast |

My frugal tool of choice to manage my finances

The one thing the spreadsheet brings me is peace of mind. Ever since I started using it, I’ve never come up short on cash. Further, I’ve been able to use it to plan purchases, such as a house, a car, or a new big screen TV. Best of all, a spreadsheet is reasonably easy to learn to use. It does take an investment of time, but I consider it a worthwhile investment of time which leads to a better quality of life.

I certainly wouldn’t recommend something as archaic as Lotus 1-2-3, unless all one can afford is a 640k PC XT; in which case, it works just as well today as it did back when it was new. Chances are good that most people have access to a reasonably modern PC; in which case I frugally recommend LibreOffice. This is a free download from http://www.libreoffice.org/ . The spreadsheet in this package is called Calc. It’s essentially a modern version of OpenOffice and works exactly the same, so tutorials such as those at tutorialsforopenoffice.org will apply. Another option that I”m starting to favour is the spreadsheet app provided by GMail and Windows Live mail. The spreadsheet program runs in my browser, and the file lives on the GMail/Windows Live server.

Learning to use a spreadsheet and then implementing it for my own purposes was another tool that paved the way to future success in my life, and is something I highly recommend to anyone wishing to improve their own future.

Saturday, 3 November 2012

Investing in myself

|

| Investment Value? |

Living for the moment

|

| Ready to sing in the church choir |

Up until the age of 20, I was, like many people, living for the moment. Each day came and went, and I was checking my horoscope and looking for other signs from God which, I now admit, wasn’t really work out all that well for me. My well meaning parents insisted I go to College straight from high school, and I did so to please them. Unfortunately, I went to College having been indoctrinated by a rather unfortunate series of experiences during my thirteen years of mandatory education; from weekly beatings by a leather strap against the palm of my hand for “misbehaviour” in the earlier grades, to not quite fitting in during high school, all the while plagued by poor grades as a result of what modern psychology has come to term, “Attention Deficit Disorder,” it’s remarkable that I managed to survive, much less get my Ontario Secondary School Diploma.

By the time I entered College, I had naturally developed a rather negative attitude towards education. More accurately, I was growing weary of the cycle that just didn’t seem to be working for me. After a couple of months, it dawned on me that I was free to leave, which is exactly what I did when I learned that my grades were by the middle of the first semester so dismal, I was not to graduate to the next year with the rest of my class. I took this as a sign, dropped out, and went out on my own to do what I wanted.

There were massive layoffs in the electrical trade I wanted to get into, so it was fortunate that I had a clean criminal record; this enabled me to work as a part time overnight security guard. I supplemented this income with construction work. At one time, I did overnight security at the same site I laboured at the next day, getting by on a mere four hours of sleep. It was exhausting, but the guard job had two important benefits: One, it exposed me to people active in their vocations of choice, and two, it gave me plenty of time to read and think.

Wake-up call in three parts

As he walked out of my sight, it dawned on me that I was going to be him if I continued to live as I was. I couldn’t afford a car, having failed at the experiment a few of times; I had my bike and took the bus when I could afford it, but the rent, food, and cigarettes were eating up much of my income. When I worked two jobs a day for a couple of weeks, I saved up enough to buy a good quality new bike, but I only did so because it saved me money in comparison to taking the bus, and the bike was certainly cheaper than a new computer. How long could I go on like that? That lead me to ponder, how could I expect to manage to even afford proper outer wear for the weather when, after I’m too old and enfeebled to work construction, I’ll be facing the prospect of delivering newspapers in the cold and miserable rain just to make ends meet? The seed of discontent was germinating and taking root in my mind.

Part two occurred after I managed to attain a full time security guard position in a government office tower. I was still making minimum wage, but the full time hours provided some relief. Three young men around my age worked in the data center overnight, and their shifts overlapped mine. By this time, I was running my own Bulletin Board System from my old computer and was familiar with much of what they were doing. In fact, watching them, I knew I was capable of learning and doing their job, and when I discovered they were earning $15 an hour (a good entry level wage for 1991 well in excess of my own $7.00 an hour) sitting around waiting for a light to come on to get up and change a data tape, I asked them how I could get such a job. One of these fellows was very kind and generous and advised me that I had to prove to an employer that I had the skills to handle such a job, and that proof was by way of certification, diploma, or degree. He explained to me that anyone could claim to be capable of doing a job, and perhaps they were, but employers have no way of knowing if they’re being honest or not. Up until this point, I lived in a Godly world where all was fair and guided by the divine and people were honest. It was at this moment that the true value of recognized education became permanently impressed on me.

Part three occurred in the late winter following part two. I called up an old friend whom I went to school with. We had started the same program in College together before I dropped out. I learned that he had stuck with the program, and was about to start a job placement as a manager. Was it really that long ago? It seemed to me as though I had just dropped out of the course a few months ago; as I thought more about it, I understood that three years had elapsed, and suddenly I realized that three years was nothing, no time at all! That’s when it all came together and I was finally able to step outside of myself. Had I had the proper frame of mind three years ago, I could have surely achieved at least a passing grade without too much effort and I would have had the proof necessary to demonstrate to employers advising them that I was indeed capable of handling a more desirable job that required greater intellect, skill, and rewarded that with greater pay.

Recognizing the investment

|

| Reinventing myself, 1993 |

I decided to go back to College for a 3 year program. I calculated that, at the time, earning what I was making, I might have been able to gross, at most, $14,560 a year. After taxes, deductions, and downtime, I was realistically realizing a mere $11,000 per year. I knew that, between rent for my seedy bachelor apartment, cheap food bought at discount, and riding my bike everywhere, I could eke by on as little as $10,000 a year if I really had to. If I got an OSAP loan to pay for my education and to help to pay my expenses, I could supplement that money with some sort of part time employment and my lifestyle really wouldn’t change from what it already was. The result? If I attained employment at even $12 an hour, my gross income would increase significantly to $25,000 a year. At $15 per hour, I would gross more than double at $31,200. If I continued my low-rent lifestyle after graduation, it would take me only two years to to pay back the loan at $12 per hour. In addition, I would end up with a much better job free of night shifts and weekend work, and once that loan was paid off, I’d be in a position to put enough money away to not ever need to worry about having to deliver newspapers in my retirement.

|

| My car and new house, 1998 |

My strategy worked much better than expected as I found that, even working at a summer job at an information systems company in 1995, $12 per hour was easily attainable, and part time work as a lab technician during the school year was really not that difficult to attain now that I was able to demonstrate my knowledge and aptitude with a certification after the first year and a diploma after the second. Upon graduating after the third year, $15 per hour became my new minimum wage. Buying and keeping a car was simple after my second year, I was able to pay off my student loan very quickly, and I was buying my first brand new house with my wife two years after graduating. My investment in myself wasn’t just growing; it was exploding at a phenomenal rate.

To sum up the investment in myself: Recognizing that my own true value will grow, given an investment of time and money. It’s also recognizing that I shouldn’t expect others to commit an investment of time and money in me if I’m not willing to do it myself. It’s a key element that governs my life today, and goes beyond time and money; necessarily, it had grown to include my health and relationships. It was a difficult lesson for me to learn, but it was definitely worthwhile as it paved the way for the rest of my life.

Friday, 2 November 2012

Welcome to my new blog

Frugality. What is it, exactly? When I was young, I believed that it meant a lifestyle of doing without. It meant a boring life devoid of good things and fun; in essence, only having money and nothing else. I have since come to learn that my initial assessment of frugality, among so many other things, was wrong.

Defining Frugality

The dictionary definition of frugality is a lack of wastefulness and prudence in saving. Wasting and saving what, exactly? Many people might assume it’s money, but I’ve come to learn it’s not just money, but also time. The dictionary also doesn’t define what constitutes the definition of what is wasteful and what is useful; that’s up to the individual to define for themselves. This means that, to some, playing videogames is a complete waste of time and demonstrates a lack of frugality, while to others the act of playing a videogame represents a pleasurable and cost-effective way to spend leisure time, delivering exceptional entertainment value for the dollar.

I’ve come up with my own definition of frugality, taking the typical dictionary definition of this word to a logical conclusion. Frugality to me means managing one’s finite amount of resources (chiefly time and money) so that one can get the most of what they want out of their life. It’s not about wanting less and having less, it’s about setting goals and making everything count. A part of this includes growing myself and making my investment of time and money today contribute to making myself more valuable to others in the future.

I do whatever I want

Frugality has allowed me to live a life doing whatever I want. That’s the key to what makes frugality so appealing to me. For example, my experience taught me that I didn’t like to work the night shift or weekends; it was simply something I personally didn’t want in my life. This helped me to identify which careers and industries would be congruent with this goal. Realizing that 1/3rd of my weekday life would be spent working (with most of the other 2/3rd’s sleeping, commuting, or doing things to get ready for work), I wanted a career that I would enjoy; something that engages my mind and body, something that blends my desire for artistic expression with my practical logic side, something full of the variety I crave. These are important for me; to live a life that I personally find fulfilling.

There are trade-offs in life. Some might call them compromises. Through the lens of frugality, I’ve come to prefer investments. Frugality means that instead of compromising or trading one dream for another, I can afford to invest money, time, or both to realize an existence where I don’t need to give up on dreams; that I really can have it all and do whatever I want. The trade-off for me has been the discipline of frugality; of resisting the come-ons of advertisers and taking the time to assess what it is I really want. To recognize the true value of the investment of time and/or money, and how every purchase I make or every moment in my life becomes part of the investment. It has to be, because, whether we know it or not, every moment and dollar we spend today is, for better or worse, an investment in ourselves and has an impact on our future.

We often see life as a path we take. Frugality allows me to take control of that path, and even change it mid-life. It’s allowed me to focus on what’s important, eliminate what’s not important, and to recognize the long-term value of how I spend my money and time today.

Hence, I blog

One of the things I enjoy doing is writing. It’s a hobby that, like video games, is a way I enjoy spending my leisure time. I decided I might as well write something that I know about, is worthwhile, and of benefit to others to appease that part of me that feels good when I’ve selflessly contributed something worthwhile to the world. As such, I will share the concepts and ideas of frugality that benefit me in hopes that future generations will come across my blog long after I’ve passed on and improve their own lot in life. If it also helps out people while I’m still alive, then my hopes will have been exceeded.